V.2.0.0

CAP: LIMITED

Stop Funding Your

Competition's Pipeline._

> Most lead vendors sell volume. We build infrastructure.

[ READ MORE ]A few months ago, I got a call from a broker in Queensland.

He'd spent $63,000 on leads in Q4. Bought them from one of the big exchanges—you'd recognise the name. He was promised "exclusive, high-intent mortgage leads."

His closings that quarter? Nine.

Not nine percent. Nine loans. Total.

When I asked him what his contact rate was, he didn't know. He'd never tracked it. So we pulled the numbers together. Out of the 400+ leads he'd purchased, he'd actually spoken to 71. The rest? Disconnected numbers. Wrong numbers. People who said they'd never filled out a form. People who'd already refinanced with someone else two weeks earlier.

Seventy-one conversations. Nine deals. Sixty-three thousand dollars.

I asked him if he'd complained to the vendor. He had. Their response was basically: "That's the market. Lead quality varies. You need to buy more volume and work them faster."

So he did. He bought more. He hired another loan officer to "speed to lead." His cost-per-acquisition went up, not down.

That's when he found me.

Here's what nobody in this industry wants to tell you:

The lead exchange model isn't broken. It's working exactly as designed.

Think about how it works. A consumer fills out a form—usually on some comparison site or "see if you qualify" landing page. That lead gets pinged to an exchange. The exchange runs an auction. Three, four, five lenders bid on it. Highest bidder wins.

Sounds efficient, right?

Here's what actually happens next.

That consumer gets four calls within the first ten minutes. Their phone lights up. They answer the first one—maybe. By the second and third, they're annoyed. By the time your loan officer calls (twelve minutes later, because your team was in a meeting), they're not picking up anymore.

You paid $80, $120, $200 for that lead. And you're not even getting a conversation.

But the exchange got paid. The affiliate who generated the form fill got paid. Everyone in the chain got paid—except you.

That's not a bug. That's the business model.

And it's getting more expensive every year. Ad costs are up 30% year-over-year. The lenders who locked in reliable acquisition infrastructure last year? They're now outbidding you on every channel. The gap isn't closing—it's compounding.

And it gets worse.

You know what happens to that lead data after the auction? It doesn't disappear.

Pull up your lead vendor's terms of service. Actually do it—I'll wait. Somewhere in there, usually buried around page 12 or 14, there's a clause that says they retain the right to store, analyse, and monetise any data that passes through their platform.

That means your prospect's financial details—their income, their payment history, whether they've had defaults or judgments or bankruptcies—is sitting in a database you don't own. Controlled by a company that makes money by selling data.

HubSpot has this clause. GoHighLevel has it. Every major CRM and lead exchange has it.

They're not hiding it. They're just betting you won't read it.

And even if you did—what are you going to do? Not use a CRM? Not buy leads?

They've got you locked in. And they know it.

I'm 22 years old. I run a company called Spear out of Sydney.

I don't have a fancy office. I don't have a sales team that's going to wine and dine you. I'm not backed by some VC fund that needs me to hit growth targets by burning your money on leads that don't convert.

What I do have is infrastructure that I built specifically because I got sick of watching this game play out.

I've worked with mortgage brokers who were spending $30K, $50K, $80K a month on lead gen—and couldn't figure out why their cost-per-acquisition kept climbing. The answer was always the same: they were buying shared leads from exchanges that profit whether you close or not.

The model is rigged. Not illegally. Just structurally. The incentives don't line up.

So I built something where they do.

Here's how it works:

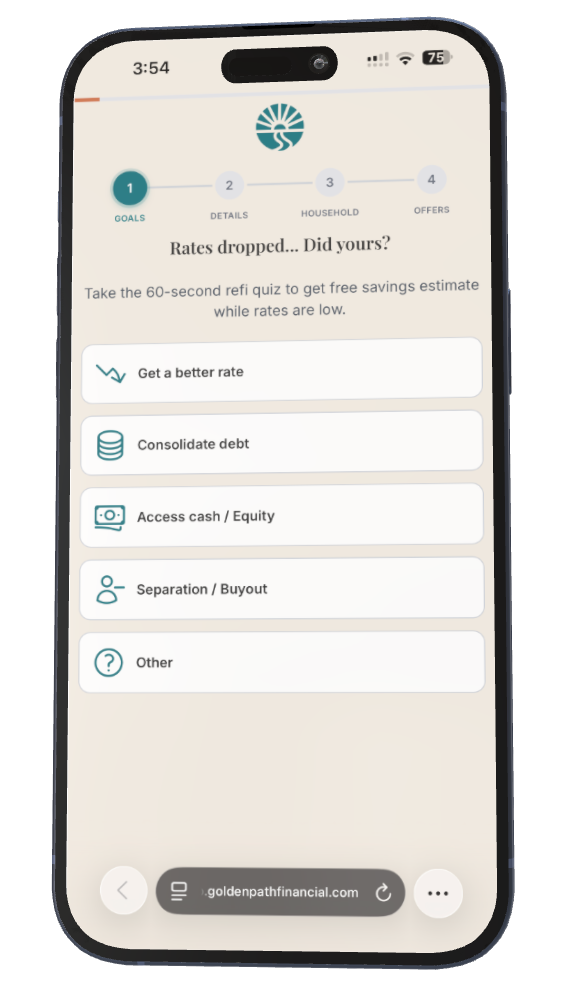

I own and operate a consumer brand called Golden Path Financial.

It's not a comparison site. It's not a lead farm. It's a premium financial guidance brand that I built from the ground up—design, copy, user experience—specifically to attract high-calibre borrowers. People who are serious. People who actually qualify. People who want help, not just a rate quote to shop around.

Every touchpoint is designed to filter for intent—not just capture a form fill.

When someone comes through Golden Path, they go through a qualification flow before they ever become a lead. Credit score. Loan amount. Property type. Location. Employment. We filter out the tyre-kickers, the unqualified, and the people who just wanted to "see what they could get" before they reach you.

The leads that come out the other end are exclusive. They go to one provider. You.

No auction. No bidding. No race against four other lenders to the same disconnected phone number.

I've built acquisition infrastructure for boutique mortgage brokers, independent insurance agencies, and multi-location franchises. No logos on a website—just results in their pipelines.

You might be wondering: why don't I just service these leads myself?

Fair question.

The short answer: I'm not a licensed broker or loan officer. I'm an infrastructure guy. I build systems, not loan files.

But the real answer is this: Golden Path only works if the providers behind it are actually good.

Think about it. If I send a lead to some churn-and-burn shop that's going to call them eight times in two hours and then ghost them when they don't convert—that consumer has a bad experience. They tell people. They leave reviews. They remember the brand that sent them into that mess.

Golden Path's reputation is my reputation. I can't afford to work with providers who are going to burn the leads and damage the brand I've spent years building.

So I'm selective about who I work with. I vet providers. I care about how you treat the leads—because if you don't treat them well, I lose more than you do.

That's why the model works. Our incentives are actually aligned.

And you still control your filters.

Just because I'm qualifying leads on the front end doesn't mean you're locked into whatever I decide to send you.

You tell me your criteria—minimum credit score, minimum loan balance, property types, states you're licensed in, whatever matters to your underwriting—and I build those filters into your funnel. Leads that don't match don't come through. You're not paying for prospects you can't serve.

This isn't a "take what you get" exchange. It's infrastructure built around your business.

Your data never touches a shared platform.

Leads are generated, stored, and delivered through isolated infrastructure. Your pipeline doesn't sit in some shared database next to your competitor's. No third-party access. No resale. No fine print that lets me monetise your data on the side.

I make money when you get leads that convert. That's it. If you don't close, I don't eat. Which means I'm pretty motivated to make sure your leads are actually good.

TRADITIONAL

- ↓ Shared database

- ↓ Sold to 4+ buyers

- ↓ Data exposed to vendors

- ↓ ToS allows resale

- ↓ You don't own it

SPEAR

- ↑ Isolated infrastructure

- ↑ Exclusive to you

- ↑ Zero third-party access

- ↑ No resale, ever

- ↑ You own it

Now—let me be straight with you about something.

Spear is not a big company. It's me, a small team, and the infrastructure we've built.

Some people see that as a weakness. I think it's the opposite.

When you work with a big lead vendor, you get an account manager who's handling 40 other clients. You get a support ticket system. You get "we'll escalate this to the team." You get ghosted when the quality drops and you start asking questions.

When you work with me, you get me. Directly. If something's wrong, I'll know before you do—because I'm watching the same dashboards you are.

I'm not trying to scale to 500 clients and flip the company in three years. I'm trying to build something that actually works—and work with people who are serious about fixing their acquisition.

That said—I've built infrastructure for clients ranging from solo brokers testing at $10K/month to enterprise lenders running $80K+ across multiple states. The builds scale. What stays constant is the attention.

Imagine your sales team spending 80% of their time on conversations instead of chasing disconnected numbers. That's what a 60%+ contact rate looks like.

Here's what I want you to do:

Send me your last 90 days of lead data. Source, cost, contact rate, close rate—whatever you've got. Doesn't need to be perfect.

I'll look at it personally. Not a sales rep. Not an SDR running a script. Me.

I'll tell you exactly where the leak is. Which sources are bleeding money. What your real cost-per-acquisition is when you strip out the leads that never picked up. And whether Spear can actually fix it—or whether your problem is somewhere else and I'm not the right solution.

No charge for this. No obligation. If I can't find at least 20% waste in your current spend, I'll tell you straight and you can move on.

Why would I do this for free?

Because if you're spending $10K, $30K, $50K a month on leads that aren't converting—and I can show you exactly why—you're going to want to work with me. I don't need to hard-sell you. The numbers will do it.

And if your numbers are actually fine? Then you don't need me. No harm done.

One more thing.

I only take on a few new builds per quarter.

Not because of some fake scarcity play—because each infrastructure build is custom. I'm not plugging you into a dashboard and wishing you luck. I'm building filters, integrations, and tracking specifically for your firm. That takes time to do right.

If you're reading this and it's early in the quarter, there's probably room. If you're reading it later, there might not be. Either way, reach out and I'll let you know where things stand.

This industry survives on opacity.

Vendors don't show you where your leads come from because if you saw the funnel, you'd stop buying. Exchanges don't show you who else is bidding because if you knew, you'd realise you're just driving up your own costs. CRMs don't highlight the data clauses because if you read them, you might leave.

Spear is the opposite of that.

You see the funnel. You control the filters. You know exactly how your data moves. And when something's not working, I'll tell you—because my model doesn't work if yours doesn't.

If you've been on LinkedIn and seen me calling out the games this industry plays—this is the company I built to actually fix it.

Let's talk.

—

Randy Beno

Founder, Spear

Sydney, Australia

P.S. — If you're spending more than $10K/month on leads and your contact rate is below 40%, you're almost certainly buying shared leads—even if your vendor swore they were exclusive. I can show you how to check in under 5 minutes. Just ask.

P.P.S. — I'm not going to chase you. I'm not going to send you 47 follow-up emails or have an SDR blow up your phone. If this resonates, reach out. If it doesn't, no stress. I'd rather work with people who get it than spend my time convincing people who don't.